Purchasing health insurance not only safeguards your family’s well-being but also brings valuable tax advantages. Under Section 80D of the Income Tax Act, 1961, individuals can claim deductions on premiums paid towards health insurance policies. These benefits extend to your family members, such as your husband or wife, dependent children, and parents.

Purchasing health insurance not only safeguards your family’s well-being but also brings valuable tax advantages. Under Section 80D of the Income Tax Act, 1961, individuals can claim deductions on premiums paid towards health insurance policies. These benefits extend to your family members, such as your husband or wife, dependent children, and parents.

So, whether you are purchasing a basic medical cover, a top-up plan or a critical illness policy for your loved ones, with Section 80D benefits, you can combine health protection with tax efficiency.

Keep reading for detailed insight.

What are the Health Insurance Tax Benefits for Families Under Section 80D?

The following are the various health insurance tax benefits for families:

-

Multi-Year Policy Tax Benefits

Most people prefer multi-year long-term health insurance policies to get discounts from the insurers. Although you pay the premium for multiple years, the deduction can be claimed proportionally over the policy’s tenure.

You can claim a maximum deduction of ₹25,000 for people who are less than 60 years old and ₹50,000 for senior citizens within a financial year.

-

Critical Illness Cover

Section 80D also includes the deduction for payments made against critical illness insurance plans. Sudden health complications like heart attack, stroke, cancer, or even diseases like dengue may result in serious medical expenditures.

By covering your family members through a critical illness policy, you are not only safeguarding their health and finances but also availing of the applicable tax benefits.

How Much Health Insurance Tax Benefits Can a Family Get Under Section 80D?

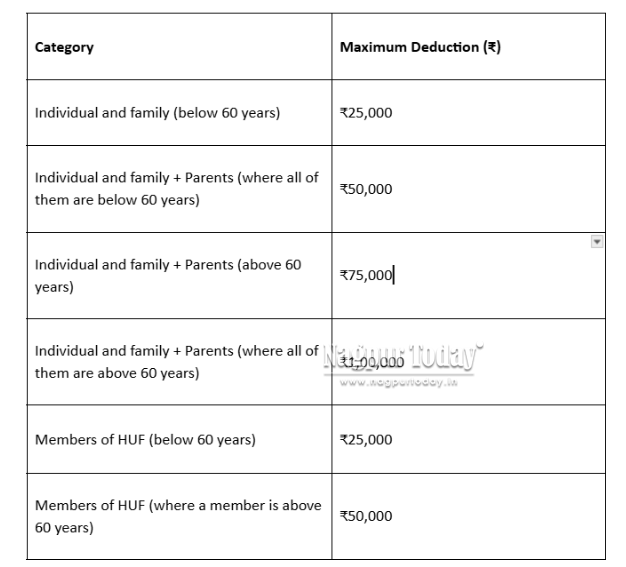

The tax deductions offered under Section 80D of the Income Tax Act differ depending on the age of the individuals insured and their relationship to the person paying the premium. Below is a summarised table highlighting the health insurance tax benefits for families available under Section 80D:

What to Remember While Claiming Tax Benefits Under Section 80D?

When claiming tax benefits on health insurance for your family under Section 80D, keep the following key points in mind:

-

Cash Payments Do Not Qualify

You must pay health insurance premiums through non-cash modes, such as cheque, bank transfer, or credit/debit card. Cash payments are not eligible for deductions.

-

Split Premiums Can Be Claimed Separately

If both you and a parent contribute to the premium, each can claim a deduction for the portion they have paid, as per the rules under Section 80D.

-

Extended Family Not Covered

Premium payments made for extended family members, such as siblings, grandparents, uncles, or aunts, are not eligible for tax deductions under this section.

-

Working Children Not Eligible

You cannot claim deductions for premiums paid on behalf of children who are financially independent or earning.

-

Employer-Paid Group Insurance Not Eligible

Premiums paid by your employer for group health insurance plans cannot be claimed as deductions under Section 80D.

-

No Deductions on Taxes and Cess

Service tax and cess included in your insurance premium are not deductible under Section 80D.

How to Select a Health Insurance Policy for Your Family?

The following are some essential factors you need to consider when selecting health insurance for your family:

-

Assess Your Family’s Health Profile

Evaluate the age, medical history, and healthcare needs of each family member. This will help determine the level of coverage your family requires.

-

Review Policy Coverage

Ensure the plan includes comprehensive benefits such as hospitalisation, pre- and post-hospitalisation care, and daycare treatments. Consider optional add-ons to expand coverage as needed.

-

Check the Network Hospitals

Choose an insurance provider that offers a comprehensive network of hospitals, particularly those located near you.

-

Understand the Waiting Period

Familiarise yourself with the waiting periods for specific treatments or pre-existing conditions. This allows for better planning of your medical expenses.

-

Evaluate the Claim Settlement Ratio

Research the insurer’s claim settlement record. A high ratio indicates reliability and timely claim processing, ensuring a less hassle-free experience during emergencies.

-

Be Aware of Co-Pay and Sub-Limits

Know whether the policy includes co-payments or sub-limits. A co-pay requires you to pay a portion of the bill, while sub-limits limit coverage for specific treatments.

-

Go Through the Policy Exclusions

Review the list of exclusions to understand what is not covered under the plan. This helps avoid surprises at the time of filing claims.

-

Compare Premiums and Affordability

Look for a plan that fits your budget while offering adequate coverage. Compare policies to ensure you are getting value for money.

-

Consider Add-ons and Riders

Explore available add-ons for additional protection against specific illnesses or risks. Review their benefits and costs before including them in your plan.

Investing in a family health insurance policy not only secures your loved ones against unexpected medical expenses but also provides significant tax savings under Section 80D of the Income Tax Act.

By understanding the eligibility criteria, deduction limits, and key policy features, you can make well-informed decisions that benefit both your family’s health and your financial well-being. Choose a plan that aligns with your needs, compare options carefully, and maximise the tax advantages while ensuring complete protection for your family.