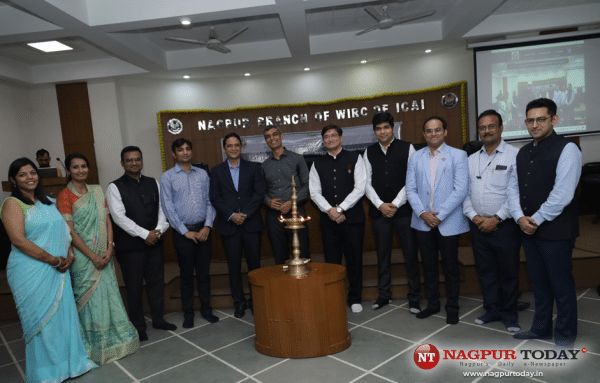

Nagpur : Nagpur Branch of WIRC of ICAI recently organised a seminar on Taxation of Shares and Derivatives wherein CA. Milind Patel, past Chairman of the Nagpur Branch graced the occasion as Chief Guest and CA. Mahavir Atal was the speaker of the session.

CA. Milind Patel, past Chairman in his address as the Chief Guest congratulated the Nagpur Branch as they have hosted a very important seminar at very apt time. He further shared key statistics that there around 9 Crores demat accounts in the country as on 31st March 2022 and the number of income tax filers is nearly 7 Crores. This brings us to very important fact that there are more demat account holders than income tax filers and in days to come there will be substantial rise in the investing and trading activity due to which all such transactions needs to be adequately reported in the income tax forms. Further with the onset of a comprehensive Annual Information Statement (AIS) now being populated by the Income Tax Department for each and every assessee such transactions in shares and derivatives will be under scanner if at all they go unreported in the ITR forms. Looking at all these factors, the seminar on shares and derivatives transactions thus becomes extremely relevant and timely as the professional would have various queries which this seminar will settle for sure.

CA. Jitendra Saglani, Chairperson of the Nagpur Branch in his opening remarks mentioned that it is extremely vital to understand the nature of transactions when it comes to income tax point of view. The assesses are not aware whether a transaction in shares is an investment activity or should that be classified as trading activity and in that case the role of professionals like CAs is very crucial as they guide the assessee on the tax implications while doing an investment activity and while doing a trading activity. Further the calculation of turnover in derivatives transactions and applicability of Tax Audit is very question that is being asked and todays session wherein the expert speaker will cover these important aspects in very detailed manner will help the participants to clear all their doubts.

CA. Abhijit Kelkar, RCM in his brief remarks, congratulated the Chairperson of the Nagpur branch, for conducting back to back, very informative session for the benefit of members. He exclaimed that in the Covid era when all of us were facing lock down, the only activity that had surged a lot is the involvement of people into the stock markets and thus there arises a need wherein we professional should guide our clientele who have recently started investing or trading in shares or derivatives to understand the tax implications of these transactions and thus this seminar which is happening for the first time in the region to help all the attendees.

CA. Mahavir Atal, the guest speaker started his deliberation by requesting members to always follow the Bhagwat Geeta of taxation that is Income Tax Act and urged all the members to go through the basics for better understanding of the topic. He covered in detail about the calculation of F & O turnover. Then, he briefed about the situation for audit of books of accounts in case of F & O. Thereafter, he detailed about the income arising out of trading in shares and derivatives to be classified as capital gains or business income. Lastly, he informed the members all the do’s and don’ts while filing ITR forms in case of Shares and F & O.

CA. Sanjay C Agrawal, Managing Committee Member coordinated the session and CA. Akshay V Gulhane, Secretary proposed formal vote of thanks. Prominently present on the occasion were CA Sanjay M. Agrawal, CA Dinesh Rathi (Treasurer), CA Deepak Jethwani (Chairperson WICASA), CA Ajay Vaswani, CA. Swaroopa S Wazalwar & CA Trupti Bhattad managing committee members and senior members CA. P.R. Risbud and CA. N. Varadrajan amongst others. The seminar was a organised as hybrid event wherein close to 100 members attended the session physically and nearly 80 members from all across the country had connected virtually making the seminar a huge success.