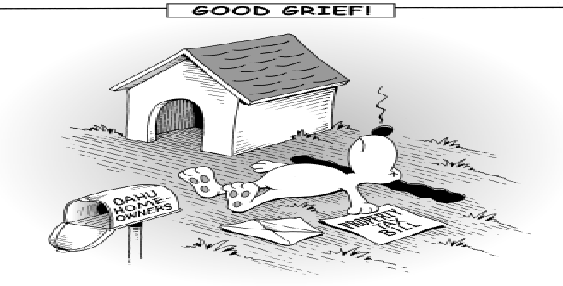

Notwithstanding the high prices of houses or plots in Nagpur, the NMC is still sending demand for an average of Rs 200 and less against property tax to be recovered from each of the owners. The prolonged re-assessment of the properties across the city has led to this situation. NMC standing committee chief Avinash Thakre has also pulled up property tax officials for the current mess.

It came to light that officials decide the taxes of properties in their concerned areas on their own will, be it for the houses, buildings, flats, shops, offices, godown or plots. Sources informed that both the officers and employees pocket huge amount in the recovery drive.

Owing to the series of irregularities, Thakre has called on a review meeting of tax department, in which he took the erring officials to task and also instructed to speed up the recovery process.

However, the recovery drive has been accelerated but it has only added to the distress of taxpayers as the officials are calculating the taxes and themselves suggesting the ‘mid-way’ out in an unauthorized manner. The current drive has only escalated the illegal extraction of money from the citizens. Moreover, the employees are being spotted at the doors of taxpayers even on their holidays.

According to an estimate, the net property tax due of Rs 10.76 is to be recovered from Laxmi Nagar zone, Rs 9.17 crore from Dharampeth zone, Rs 10.78 crore from Hanuman Nagar zone, Rs 3.48 crore from Dhantoli zone, Rs 5.86 crore from Nehru Nagar zone, Rs 3.64 crore from Gandhibagh zone, Rs 4.10 crore from Satranjipura zone, Rs 9.64 crore from Lakadganj zone, Rs 8.02 crore from Aasinagar zone and Rs 9.73 crore from Mangalwari zone. These total up to a net outstanding of Rs 75.18 crore in the form of tax recovery from all the zones.

Surprisingly the NMC has not issued any warrant against the defaulters.

Thakre informed that the property tax department has been given two months time for completing the recovery. He also pressed for evaluation of tax as per the existing property rates. He said that the official figure of due tax is quite less than what exists in reality. He claimed that if the property tax department would honestly delve deeper to churn out the defaulters, the net due to be recovered may touch around Rs 200 crore.

Even if the reassessment of the properties, on which the nominal rates are being applied, would be done then this alone could fetch around Rs 50 crore extra. More than 40 percent of the properties in the city are surviving with the old rates and has never been assessed. The proper assessed value of such properties would touch Rs 100 crore in the form of its property tax.

However, it remains to be seen how the new standing committee chief Thakre would help in improvising the recovery to add to the exchequer.