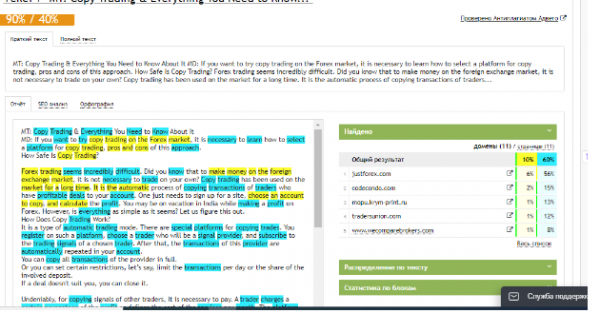

MT: Copy Trading & Everything You Need to Know About It

MD: If you want to try copy trading on the Forex market, it is necessary to learn how to select a platform for copy trading, pros and cons of this approach.

How Safe Is Copy Trading?

Forex trading seems incredibly difficult. Did you know that to make money on the foreign exchange market, it is not necessary to trade on your own? Copy trading has been used on the market for a long time. It is the automatic process of copying transactions of traders who have profitable deals to your account. One just needs to sign up for a site, choose an account to copy, and calculate the profit. You may be on holiday in India while making a profit on Forex. However, is everything as simple as it seems? Let us figure this out.

How Does Copy Trading Work?

It is a type of automatic trading mode. There are special platforms for copying trades. You register on such a platform, choose a trader who will be a signal provider, and subscribe to the trading signals of a chosen trader. After that, the transactions of this provider are automatically repeated in your account:

- You can copy all transactions of the provider in full.

- Or you can set certain restrictions, let’s say, limit the transactions per day or the share of the involved deposit.

- If a deal doesn’t suit you, you can close it.

Undeniably, for copying signals of other traders, it is necessary to pay. A trader charges a certain percentage of the profit or defines the cost of the services per month. The platform through which the copying takes place also has its own profit. It can be a percentage of the subscription cost. Copy platforms work in partnership with brokers to attract providers and subscribers. As you can see, it is a business in which all the participants should gain a profit.

How Does the Process Work?

How Does the Process Work?

Successful traders sign up for the auto trading platform and publish their profiles with signals for subscribing. This is how they become signal providers. The following steps are:

-

A subscriber chooses a supplier on such a website or the broker’s site and subscribes to the signals of a chosen trader. -

This trader concludes transactions on the trading account of a chosen broker. -

Transactions are transmitted through the platform to the subscriber’s server of the broker, and then to the trading account of a client.

It is recommended that the amount on your account should be equal to the provider’s balance. So, if a trader has a deposit of $10,000, and you only have $100, trading will be unrealistic for you. A trader can open a lot that will be equal to your entire deposit. On the other hand, some services scale the volume of transactions depending on the balance between a provider and a subscriber. If you want to copy trade in the Forex market, carefully read the terms of use to understand the ratio of profit and loss for the supplier and for you. Also, it is necessary to select a signal provider working with a trusted broker like Forextime.

How to Choose a Reliable Trader to Copy Signals?

In the trading market, providers are evaluated by their ratings. The higher the rating, the more expensive it is to subscribe to signals. So, here is what you should pay attention to:

- The history of trading should be long (at least 60 days), and there should be a lot of transactions.

- Numerous subscribers confirm the demand for a trader.

- Evaluate the trader’s strategy, how many deals per day are concluded? If the trader is a scalper, is the strategy too risky?

- The monthly income should be average, i.e., 15-30%.

Newly registered providers often provide their signals for free to gain a rating. If you don’t have enough funds for signals from in-demand providers, take a chance and turn to new ones.

Pros and Cons of Copy Trading

Pros and Cons of Copy Trading

The main benefits of copying signals from other traders are:

- Profit without knowledge: you profit from trades regardless of your knowledge and skills in the Forex market. Professional traders take care of this.

- Trading style: you select a trader the style of which suits you.

- More free time: you don’t have to devote a lot of time to constantly check the situation in the market.

- Multi-trading is possible: you choose as many signal providers as you like. This way, you diversify your risks. That is, you will reduce possible losses, and you will definitely not lose everything at once. Losses on some signals will be offset by gains on others. The total profit may decrease, but risk control is worth it.

Here are the cons of copy trading:

- Risks are high: The forex market is volatile. Despite good indicators and profitable trades, a trader can make a mistake and lose money. Therefore, be aware of the risks.

- Professional degradation: When you copy trade, you lose your own skills. You don’t follow the market, you don’t learn from mistakes, you don’t apply technical and fundamental analysis.

All in all, it is up to you to decide. However, the popularity of this approach speaks for its profitability.

How Does the Process Work?

How Does the Process Work? Pros and Cons of Copy Trading

Pros and Cons of Copy Trading