Nagpur: A trader has accused some employees of Union Bank of India (Gandhibagh Branch, Nagpur) of abetting a fraud and putting him at loss of Rs 1.92 lakh.

The trader and account holder, Rajesh Narang, in his complaint said that he has an account (No. 323205040000352 ) in Union Bank of India (Gandhibagh Branch) in the name of his proprietorship concern Sumeet Electronics. On November 12, 2020, his account was debited for Rs 1,92,000 (NEFT) in the name of Salahuddin using a fake cheque leaf and forged signature on NEFT Form which was submitted by a fraudster at Rajasthan Branch. After detecting the suspicious transaction, Narang immediately lodged a complaint in this regard with Branch Manager within an hour of the fraud transaction and also lodged a police complaint about the same.

Narang suspects role of some employees of Union Bank of India in abetting the fraud. “This fraud is not possible without the support of the Bank employee. The bank employee must have leaked the unused cheque numbers and my specimen signature with bank,” Narang charged.

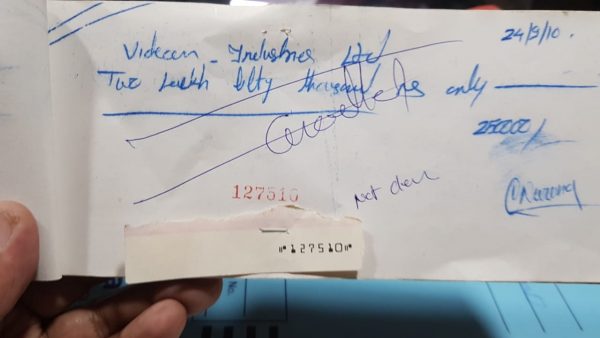

He further said that the bank employee passed a fake cheque (The original cheque was non-CTS 2010 complied, however, the fake leaf is of the new format. Also address of branch is incorrect on the cheque). The forged signature was also approved as is clearly evident. Furthermore, the bank accepted NEFT Form without proprietor the stamp of Sumeet Electronic. The Bank did not contact the home branch for outstation NEFT. Most importantly, the bank passed a 10-year-old cheque leaf without enquiring (The cheque series is non-CTS 2010 complied which is banned since January 1, 2019), Narang stated in his complaint.

“It has been seven days and I have not received my money back, even the Branch Manager of Rajasthan is not cooperating and supporting the fraudster. We are in possession of all the evidence that proves the cheque and signature are fake and the old cheque which was canceled is also with us. This is a clear case of bank fraud which requires serious attention as internal employees are surely involved in the said fraud,” Narang claimed.