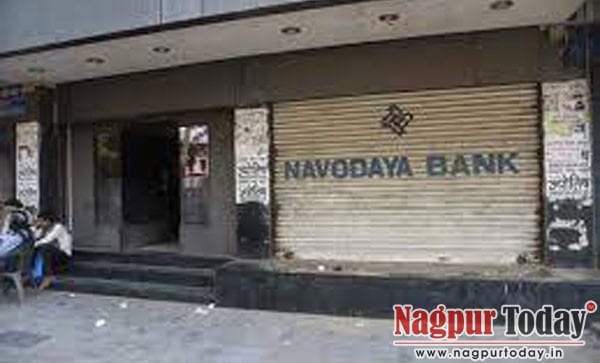

Ex-Chairman Ashok Dhawad, Board of Directors, others face police heat

Nagpur: In a damning revelation, it has come to the fore that the former Chairman Ashok Dhawad, Board of Directors and some office-bearers of Navodaya Urban Co-operative Bank Limited committed a loan fraud of Rs 38.75 crore with the connivance of a few ‘selected’ borrowers of the bank. With the fraud, all the accused duped the genuine depositors of their hard-earned money.

As the fraud came to light, Dhantoli police have tightened the noose around the accused by booking them under Sections 406, 409, 420, 120(b), 465, 467, 468, 471, 477 (a) of IPC read with Section 3 of Maharashtra Protection of Interest of Depositors Act and Sections 65, 66 (b) of Information Technology Act in the offence 181/2019. The scam is being investigated by the Economic Offences Wing (EoW) of Nagpur police after Dhantoli Police had booked former Chairman Dhawad, Board of Directors, office-bearers, officers and a few ‘selected’ borrowers of the Bank in the Rs 38.75 crore loan fraud.

Shrikant S Supe, District Special Auditor (Class I) Co-operative Societies, Bhandara, had lodged a complaint that former Board of Directors, office-bearers, and officers sanctioned loans to some persons without valid requirements between 2010 and 2017. According to the complaint, the office-bearers also returned the original documents of the properties mortgaged with the bank and issued no objection certificates to those who had not made the repayment of the loans. While disbursing loans to some parties, they prepared fake registration documents and showed them on record as genuine. The bank sanctioned loans to some persons despite being fully aware that their properties were in dispute.

Fraud in the name of employees who had left service:

The Reserve Bank of India (RBI) had cancelled the licence of the bank on October 8, 2018 as it had no adequate capital and earning prospects and did not comply with the provisions of the Banking Regulation Act, 1949. Despite the RBI moratorium, the Board of Directors and office-bearers of the bank continued illegal business. Moreover, the Board of Directors and office-bearers tampered with the computer records using the names of employees who had resigned from the bank. Likewise, they defrauded the genuine investors of Rs 38.75 crore. On the basis of the complaint, police had registered an offence under Sections 406, 409, 420, 120(b), 465, 467, 468, 471, 477 (a) of IPC read with Section 3 of Maharashtra Protection of Interest of Depositors Act and Sections 65, 66 (b) of Information Technology Act, against the former Board of Directors, office-bearers and some borrowers.

Audit exposed the scam:

According to reports, a large number of depositors had made fixed deposits in the bank. However, despite completion of the time limit of the fixed deposits, the depositors were deprived of dividends and interests and thus they were cheated. In the scam pertaining to misappropriation of funds in Navodaya Urban Cooperative Bank, Dhawad along with other bank directors have been booked by the Economic Offences Wing (EOW) on the basis of a complaint lodged by the auditor of State Department of Cooperatives. All of them were accused of duping hundreds of investors by distributing bogus loans between 2010 and 2015. Subsequently, the cooperative bank went into liquidation after its banking license was cancelled.ago. Frauds were reported following an audit conducted for financial years 2015-16 and 2016-17 allegedly involving Dhawad and his team of directors.