For many decades Western Coalfields Limited with H.Q. at Nagpur was a sterling success story.

It could definitely be called a ‘Navratna of Maharashtra’ if not India. Thermal power being the main stay of the industrial state of Maharashtra, the coal mined by WCL went towards running our Mega Power plants – mostly situated in Vidarbha – that kept our industries humming and our cities lit up.

It is therefore shocking to learn that WCL is in the throes of becoming a ‘sick industry’ with mounting losses of thousands of crores. This year it has recorded a loss of Rs. 2829.28 before tax, which is up Rs. 1100.00 crores from last year’s loss of Rw. 1775.52 crores.

What is even more alarming is that the loss of revenue and mega losses are not coming from any new developmental activities/ expenses but from non – remunerative expenses.

As per their own Balance sheet for the current year ( which is the public domain), this is what their Chairman cum Managing Director Rajiv Ranjan Mishra’s report says:

During the year i.e. 2017-18, your Company has excelled its performance in all physical parameters namely Production, Over burden removal and dispatch and achieved turnover of Rs.12,432.20 Crores but incurred a loss of Rs. 2829.28 Crores before tax as against a loss of Rs. 1075.52 Crores in last fiscal.

Three major contributors attributing to increase in loss and their approx. impact are provisioning for gratuity due to raising of ceiling from Rs. 10 lakh to Rs. 20 Lakh (Rs.1323.97 Cr.), Overburden Removal Adjustment (Non Cash Loss/ Book Loss – Rs.938.82 Cr.) and provisioning for increase in salary of Non- Executive Employees under NCWA X & Executive Salary Revision (Rs.634.73 Cr.).

Thus we can see that according to the Chairman himself, increase in salaries and payment of gratuities and such non – remunerative expenses is causing the heavy losses.

Can the country afford Coal Mining companies going into such hefty losses?

Our Power Minister Shri Piyush Goyal, has set very ambitious targets for Coal Production before Coal India Limited, of which WCL is a susbsidiary. As the above stated report itself says in its preamble:

” Indian Coal Industry needs to augment coal production at ‘unprecedented rate’ to reach planned level of 1.5 Billion tons (of mined coal) by 2020″ i.e. less than two years from now.

The target set for WCL itself is 55.00 Billion Tons in two years.

It’s production for this year was 46.22 Million tons, up just marginally from last year’s production of 45.63 Million tons.

This amounts to a growth rate of a paltry 1.2% per annum. This is as against a growth of 7.5% as set by the Planning Commission in 2017.

This despite the fact that 19 new projects were added in the last 3 years.

If the slow growth and ‘sickness’ of WCL grows where is coal going to come from?

To reiterate the Chairman’s Vision statement:

Energy is the prime mover for the growth of the nation and coal is the primary source of energy in India. Coal is the most dominant source in India’s energy scenario & meets around 55% of primary commercial needs. Around 76% of India’s power generation is coal/ lignite based and Coal will remain India’s main energy source for the next three decades.

Shall we be forced to revert largely to imported and expensive Coal?

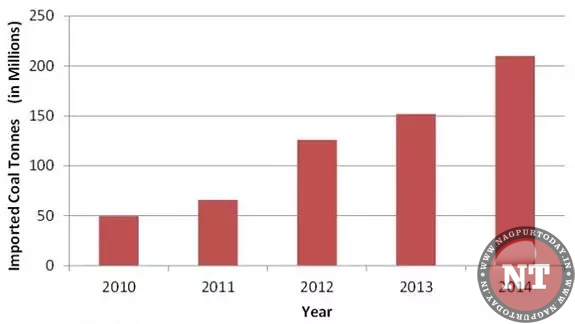

Given below is the chart that shows the discrepancy between our demand and supply that is being supplemented by increasing imports-

Coal imports to India. Source: World Coal.

Despite India’s efforts to reduce the volume of coal imports, it appears that the demand for coal is outpacing all of the actions. It is difficult to see this trend reversing anytime soon, unless there is a major delay in India’s plans for development in its economy and infrastructure.

This was the scenario before the present government took over.

In the last year of UPA 2, the alleged Coal Scam happened, which is now being cited as one of the main reasons for the Coal shortage the nation faces now.

What the ‘Coal Scam’ cost the nation and the Power Sector?

After the Supreme Court cancelled allocation of all captive coal blocks in August 2014, the coal ministry reallocated as many as 31 mines via auction to private sector end users in 2015.

Of these, only 12 have got permission to start production. The remaining 19 are still awaiting approval.

At the time of the auction, Goyal said that states would get Rs 1.93 lakh crore in revenue over the production life of these blocks, or Rs 6,500 crore a year. Against that, states have realised proceeds of just Rs 2,543 crore over last two years.

End users, who had already invested in associated power and steel projects, bid aggressively to regain their lost coal blocks. Now most of them find that their business has become unviable and want to surrender coal blocks.

Dismal performance of Goyal as Coal Minister

As per a report in Wire on Goyal’s performance -Even as Piyush Goyal is close to completing four years of his five-year tenure as coal minister, there is little relief for the power sector on the fuel supply front.

If anything, the fuel shortage has worsened for the industry despite Goyal’s promise of turning around the coal sector.

India’s coal imports stood at 217 million tonnes in 2017-18, higher than 212 million tonnes in 2014-15, setting back Goyal’s plan to end India’s dependence on overseas reserves.

The average coal stocks of power plants fell to ten days in 2017-18 from 27 days in 2015-16 while the number of generating stations with critically depleted fuel inventory shot up from two to 56.

After he took charge of the coal ministry in 2014, Goyal had promised to step up coal production and end India’s dependence on imported coal by 2016.

While coal imports have risen by nearly 14% in 2017-18 after dropping initially, Coal India (CIL) is struggling to step up production.

The government had initially targeted 660 million tonnes of coal production target for CIL in 2017-18 but later slashed it to 600 million tonnes. The public sector coal producer has failed to meet even the revised target.

Coming back to WCL, the C&MD admits that meeting targets is going to be difficult for his Company too in view of “adverse geo mining conditions and paucity of of reserves amenable to mega projects.”

But looking to its mounting losses, and growing liabilities, as reflected in their Balance sheet, not just paucity of projects, it seems paucity of funds is going to be a problem too!

Sunita Mudaliar

Executive Editor

(to be continued…)