Nagpur: A normal middle-class family often has a four-wheeler in their check list, which obviously, they tick last! Buying a new car is considered as an achievement for many as it brings luxury de facto to Indian families. However, while buying a new car, if you could review the invoice, you would surely be taken aback by the amount of taxes mounted on the new member of your family.

There has been a 15-20% hike reported in the recent time, due to low productivity and even after that you would have to wait around eight-nine months for the delivery (if you have any specific models or colour in mind). Even after so much hustle, you would end up putting around 60% of the car amount in the Government’s pocket in the form of various taxes.

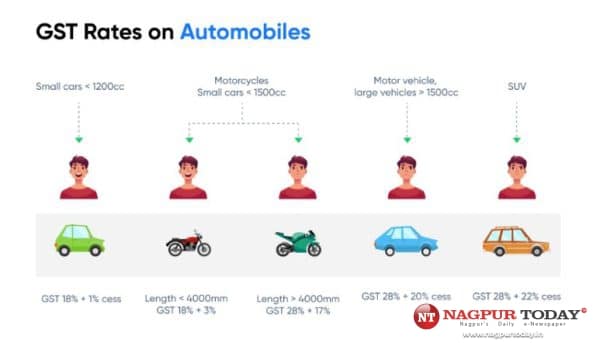

Small cars (<1200cc) attract lowest GST and Cess i.e. 18% and 1% respectively. While large vehicles (>1500cc) pocket 28% GST and 20% Cess for the Government; SUVs, among all, are more beneficial when it comes to generating revenues of the Government. An SUV contributes 28% GST and 22% Cess to the Government coffers.

Notably, Road Tax, Clearance Tax and others Taxes are yet to be added to your bill.

When it comes to motorcycles, the tax is measured on the basis of the length.