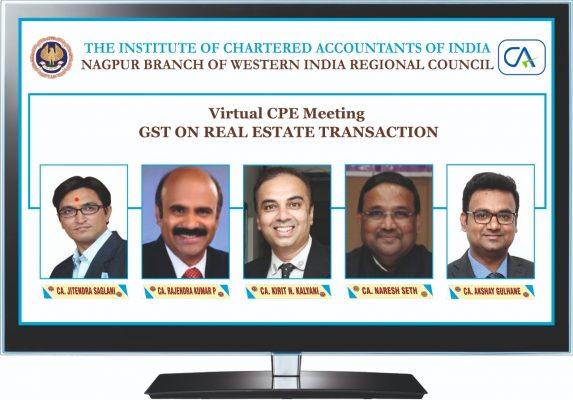

Recently Nagpur Branch of WIRC of ICAI, successfully hosted Virtual CPE Meet cum Webinar on –“GST onReal Estate Transactions”. Nagpur Branch of ICAI, continuing with its commitment to serve the cause of profession, regularly is organising webinars of due relevance for members. Real Estate transactions, as are known to involve high stake and effective planning, valuable guidance is must to serve the clients properly. With this in mind and to enable members update their knowledge bases with respect to crucial GST provisions, Nagpur Branch organized the webinar.

CA. Rajendra Kumar P., Chennai, Hon. Central Council Member and Chairman, GST and Indirect Taxes Committee, Institute of Chartered Accountants of India, in his inaugural addresssaid that, mode, manner and method in which construction agreements are written differ from state to state. Hence webinars and certificate courses to update members through concerned regions and branches, are of due relevance to members, he opined. He informed the members about various initiatives taken at Central Level of Institute, for the benefit of members.

CA Rajendra Kumar P., added to his words of wisdom that, India is an important contributor to a range of OECD standard-setting activities and is doing pioneer work. He shared with members that, it feels proud to find that, Indian participation is immense at OECD forum. Its commitment to ensure better policies for better lives is evident to find required amendments at various times to fecilitate effective implementation of GST in India, he added. Going forward, GST is bound to be there as best legislation to follow, get acquainted with the provisions and practice for satisfaction in professional arena, he added. He congratulated CA Kirit N. Kalyani, Chairman, Nagpur Branch for the apt events for members and recognized the branch as one of the most active branches of Western Region. He assured that GST and Indirect Taxes committee will always be available for cause of trade, industry and chartered accountants, in the matter of due representations to Government.

CA Kirit N. Kalyani, Chairman of Nagpur Branch, took the opportunity to convey that this webinar has been organizedin the best manner possible, for serving the members. He sincerely welcomed on the virtual dias and duly recognised the commitment to serve the cause of profession of CA.Rajendra Kumar P., Hon. Central Council Member, ICAI, who graced the occasion as Chief Guest and Speaker CA.NareshSheth, Mumbai for taking great efforts and agreeing to deliberate and guide the members regarding GST on Real Estate Transactions.

CA Kirit N. Kalyani, went further to briefly recall earlier visits of dignitaries at Nagpur and conveyed that their words of wisdom and effective guidance, are always valuable for members of branch. He briefed about the future webinars and other events for members and students. He appealed to the large number of members attending the webinar to grab the opportunity and resolve every single doubt for the subject concerned at the experienced hands of CA NareshSheth. Before wishing to have joyous and fruitful learning session, he appealed to the attendees to remain in touch with efforts and ventures of Nagpur Branch to stay updated at all

In the technical session, CA. Naresh Sheth, from Mumbai, guided the members on various important aspectsin Joint Development Agreement, GST on Sale of Developed Plots & other burning issues. He started his deliberation with guidance on amended scheme of taxation from April 2019. He made a valid point that sale of completed flats or commercial units after getting occupancy certificate, are not liable for GST. He shared mandatory conditions to follow for complying with new scheme. He went on to guide with many practical examples. Mode and manner to calculate the threshold for affordable housing apartment, were explained in details, to enable the members plan benefits of exemptions for their clients.

CA Naresh Sheth, touched various crucial issues including the taxability for free flats allotted to land owner, transfer of development rights, tdr, fsi, etc. His rich experience was evident in his deliberation of about 2 hours. He guided the members with respect of taxability in case of sale of developed plots, allowability of ITC in respect to tax charged by vendors, works contractors, etc. He dealt with many practical cases and resolved queries of members attending the webinar. He signed off on a very humble note and thanked Team Nagpur for providing the opportunity to serve the fraternity, through such an effective Virtual Program for members of the Nagpur Branch.

CA. JitenSaglani, Secretary coordinated the Virtual CPE Meet cum webinar. CA AkshayGulhane, WICASA Chairman, co-ordinated the Questions & Answer Session & proposed formal vote of thanks.

Prominently present on the occasion were CA SaketBagdia, Vice Chairman, CA Suren Duragkar, Imm. Past Chairman, CA Mohinder Chawla, CA VijayaBothra, CA RenukaBorole and more than 275 CA members.