The cash market segment for equities achieved a historic milestone, surpassing Rs 1 lakh crore in average daily turnover (ADTV) for the first time in December so far, driven by the Indian markets hitting new highs.

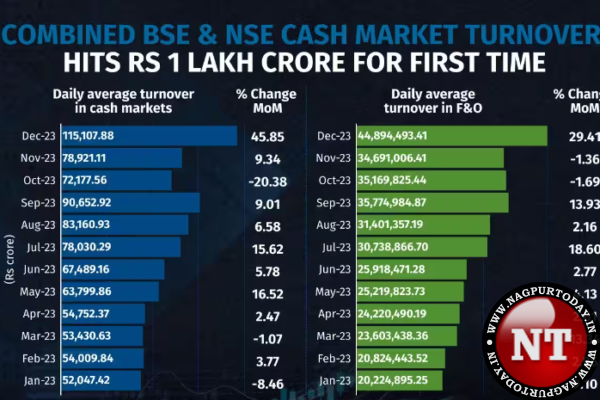

The combined ADTV for NSE and BSE reached an all-time high of Rs 1.15 lakh crore in December so far, up 45.85 percent from the previous month.

Investor participation surged despite elevated valuations. Both Sensex and Nifty surged nearly 15 percent each so far this year while BSE MidCap and SmallCap jumped 45 percent each with fresh record highs.

The increase in ADTV was influenced by various factors. Analysts attributed this rise to IPO listings across both the mainboard and SME segments, drawing in investor funds. Additionally, the month witnessed numerous block deals involving promoters, large fund houses, or individual investors.

“We have seen good attraction by market participants in all the segments as positive news in terms of cooling inflation, expectations of Fed officials beginning cutting interest rates as soon as March and several rating agencies stating that India is among the world’s fastest-growing sovereigns, with resilient GDP growth, etc, attracted investors and will continue to do so in the longer-term prospect as well,” said Raj Vyas, Vice President- Research, Teji Mandi.

Meanwhile, combined future and option average daily turnover for both exchanges also hit a fresh all-time high of Rs 448.94 lakh crore during the month, up 29.41 percent from a month ago.

“F&O market volumes rose even as the upside volatility in the Nifty led to higher activity in Index futures and options. Traders resorted to F&O to take benefit of this volatility while hedgers indulged in higher activity to protect their existing positions. Global index review/reshuffle led activity added to volumes on some days,” said Deepak Jasani, Head of Retail Research of HDFC Securities.

Bullish in 2024

As 2024 begins, analysts anticipate an increase in bullish momentum in global markets. India experienced record domestic SIPs alongside declining bond yields in 2023. This trend may attract significant Foreign Institutional Investor (FII) flows. The ongoing steady domestic SIPs and anticipated large FII investments are expected to bolster the markets further, prompting analysts to forecast an upward trend in ADTV.

Analysts emphasise the diverse strategic choices provided by new contracts, particularly weekly expiries, for hedge funds. Managed futures and options strategies empower investors to leverage trends and momentum across asset classes.

Moreover, there has been a significant surge in total demat accounts, escalating from around 4 crore in April 2020 to over 13 crore at present. The influx of numerous newcomers into the market has resulted in excessive intraday trading and increased activity in derivatives, said VK Vijaykumar analysts with Geojit Financial.

Analysts note that growing stock market participation reflects heightened investor awareness and a pursuit of wealth creation. The Digital India theme has empowered individuals from smaller towns to engage in financial markets, contributing to enhanced market depth and improved price discovery.

Shrey Jain, Founder and CEO at SAS Online, said market participants are willing to own Indian stocks. Expectations of broad-based growth in corporate earnings and cuts in interest rates in CY2024 should keep the stock markets buoyant, he added.