When you refrain from filing a claim against your car policy for a year, your effort does not go to waste. On the contrary, you get to claim the No Claim Bonus or NCB, which acts like a discount on your upcoming policy premium.

When you buy car insurance online, you get rewarded for a claim-free year through NCB at the time of policy renewal. Let’s learn more about NCB in the lines below.

What is a No Claim Bonus in Car Insurance?

The No Claim Bonus in car insurance is a reward offered as a discount on your premium when you renew your policy. This discount applies if you haven’t filed any claims during the policy year and is applicable only if you invest in an own-damage or comprehensive car insurance policy.

Working and NCB Insurance Calculation in Car Insurance

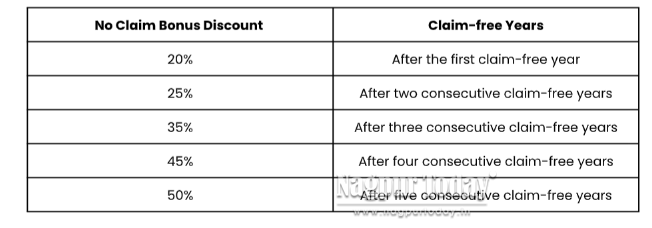

Say you refrain from making a claim for a full insurance term. When you renew your policy, your insurer will offer you a discount on your own damaged motor policy or comprehensive car policy at the time of your premium renewal. The discount begins at 20% once you renew the policy after your first claim-free year, then increases up to 50% once 5 consecutive claim-free years have passed.

Here is a breakdown of NCB insurance calculation over the years:

Let’s take the example of Mr. A, who is paying an insurance premium of ₹15,000, of which his own damage component comes up to ₹12,000. When he claims NCB for 5 consecutive claim-free years, then a discount of 50% would mean that he has to pay ₹6,000, which is a significant saving.

Let’s take the example of Mr. A, who is paying an insurance premium of ₹15,000, of which his own damage component comes up to ₹12,000. When he claims NCB for 5 consecutive claim-free years, then a discount of 50% would mean that he has to pay ₹6,000, which is a significant saving.

Benefits of NCB in Car Insurance

- Lower Premiums, Bigger Savings – For every claim-free year, you get a discount on the premium that starts at 20% and increases every year consecutively to reach up to 50%. With half the premium cost slashed at the time of renewing the policy, you can save a substantial amount.

- NCB Transfer Option – No Claim Bonus can be transferred conveniently from one car to another if you decide to switch to a new car. Also, NCB can be transferred from one insurer to another if you choose to change your insurance company.

- Discount for Policyholders – This discount on premiums is offered to policyholders and not to cars, which is why it can be transferred from one car to another.

- The No Claims Bonus Protection – You can also opt for the NCB Retention Cover that will help you achieve a claim-free year to enjoy the discount from it while you make claims during that year.

Conclusion

No Claim Bonus is a positive reward that you earn for driving carefully and responsibly throughout the year. The discount on premiums can be financially helpful as paying policy premiums can get monetarily overbearing over the years. By maintaining a claim-free record, you not only save on insurance costs but also demonstrate a commitment to safe driving, which can further enhance your overall savings.