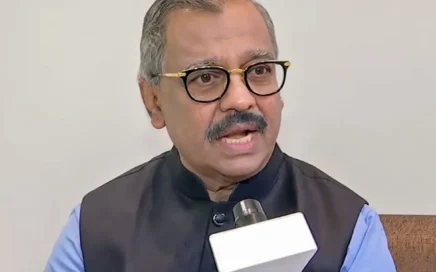

The government is in talks with at least 7-8 more countries to expand the reach of UPI beyond its borders so that domestic travelers can use the payment service, said M Nagaraju, secretary, Department of Financial Services, ministry of finance.

UPI (United Payments Interface) services will be available for Indians in those countries by next year, he said. Currently, UPI services are available to Indians travelling to Singapore, the UAE, France, Nepal, Bhutan, Mauritius and Sri Lanka.

“Our goal is to ensure that UPI is available first in the Middle East and East Asia, where there are a large number of Indians, and then go to Europe,” Nagaraju said. NIPL, the wholly owned subsidiary of the National Payments Corporation of India (NPCI), is tasked with deploying home-grown payments systems such as UPI and the RuPay card scheme overseas.

UPI clocked its highest-ever numbers in volume and value in October, with 20.7 billion transactions worth Rs 27.28 trillion being made during the period, driven by increased business activities due to the festival season, coupled with GST 2.0 reliefs.

Commenting on the banking sector, Nagaraju highlighted that all the bad indicators of the banking sector are declining. The gross non-performing assets of the Indian banking sector have declined from 11.2 per cent in FY18 to 2.2 per cent in March 2025. The numbers of both private-sector and public-sector banks look robust, Nagaraju said, adding that credit growth in the economy has been robust.

According to Nagaraju, the banks are in the pink of health because of the reforms undertaken by the Reserve Bank of India, the government, and the banks themselves. Additionally, he emphasised that the scale-based regulatory framework introduced by the RBI and supported by the Department of Financial Services has brought greater discipline, transparency, and risk sensitivity to the sector.

On the insurance sector, the DFS Secretary said that for the government, insurance is a high-priority area, and it should be a high-priority area for society as a whole as well.