- Nagpur reports lowest turnout in Vidarbha with less than 50%, Gadchiroli-Chimur tops region with 65.87%

- Nagpur Division’s Innovative Initiative to Provide Drinking Water to Passengers in Crowded Trains, Platforms

- Lok Sabha Elections: Nagpur reports less than 50%, Ramtek 52.38% voting by 5 PM

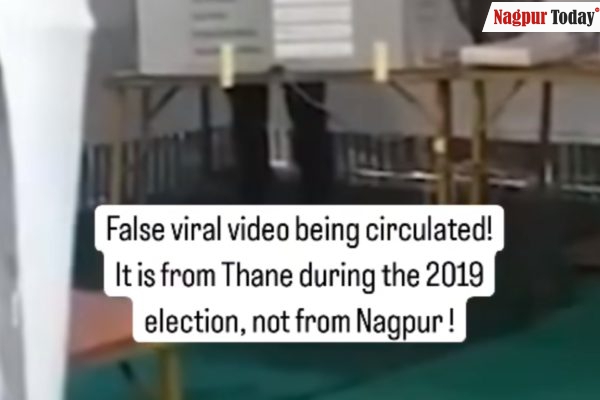

- Fact Check: ‘Ink Thrown at EVM’ Video from Thane circulated as from Nagpur during 2024 Lok Sabha Polls!

- LS polls: Jyoti Amge, world’s shortest living woman, casts her vote in Nagpur

- Lok Sabha Elections: Nagpur witnesses 38.43% turnout, 40% voting in Ramtek by 3 pm

- Lower voter turnout in Nagpur as 38.43% voting recorded till 3 pm

- Two men held for stealing Rs 3.50 lakh cash from steel trader in Nagpur

- Lok Sabha Polls: Nagpur records 28.75% voting, Ramtek 28.73% at 1 PM

- Video: Unwanted Visitor – Snake appears at KDK College during Lok Sabha Election voting in Nagpur

- PT Usha urges RTMNU to make full use of synthetic track, produce best players

- Fare concession: HC refuses to interfere in Railway policy, dismisses petition

- 3 goons attack paan kiosk owner murderously in Nagpur’s Jaripatka, held

- I will definitely win by a very big margin: Gadkari

- Festival of democracy begins: Fadnavis

- LS polls: Jyoti Amge, world’s shortest living woman, casts her vote in Nagpur

- Google Doodle Marks First Phase Of Lok Sabha Elections 2024 With Voting Symbol

- ED attaches Rs 98 cr worth assets of Shilpa Shetty, husband

- Supriya Sule files her nomination papers

- Nestle under Govt scanner for adding sugar to baby food in India

Top Picks News

Happening Nagpur

A Heartwarming Celebration: Hyaat Boutique Hosts Women-Only Eid Event

In a heartfelt celebration of community and tradition, Nikki Rangoonwala the founder of Hyaat boutique recently hosted an exclusive women-only Eid party that brought together... More...

Nagpur Crime News

Two men held for stealing Rs 3.50 lakh cash from steel trader in Nagpur

Nagpur: A team of Unit-3 of the Crime Branch of... More...

- 3 goons attack paan kiosk owner murderously in Nagpur’s Jaripatka, held

- Man kidnapped by sister’s harasser in Nagpur, rescued from MP

- Smart move: State-of-the-art Mobile Forensic Vans to bolster crime scene investigations

- MCOCA slapped on 7 members of Ramteke gang in murder case in Nagpur

- Video: Tuition class dupes students of lakhs on pretext of ‘college-private classes’ tie-ups in Nagpur

- Symbiosis student in Nagpur loses Rs 23 lakh in investment fraud

- Two more men arrested from Mumbai for duping Nagpur trader of Rs 5.4 cr

- Tajuddin Baba descendant gets death threat from Pak Taliban after joining BJP: Report

- Nagpur CP urges ‘Good Samaritans’ to help road mishap victims, save life

Sports News

PT Usha urges RTMNU to make full use of synthetic track, produce best players

Nagpur: “Rashtrasant Tukadoji Maharaj Nagpur University (RTMNU) sports complex should make full use of the synthetic track to produce better athletes,” urged President of Indian Olympic Association, Padmashri PT Usha.... More...

-

Bench beat Bar in friendly cricket match in Nagpur

Nagpur: The Bench prevailed over the Bar in a keenly-contested battle that was fought --- far away from the courtrooms --- on a cricket pitch... -

Electrifying Eels Emerges winner( boys category)) & Cool Kingfisher (girls category) at Raisoni Premier League Season 9

The closing ceremony of RPL Season 9 marked the culmination of yet another magnificent cricketing extravaganza. As the sun set on the thrilling matches and...

School And College News

Convocation Ceremony for Grade – Preparatory

The Kindergarten Convocation is the culmination that marks the new journey of a child towards higher education where they will be exploring new ideas and things and shaping themselves into... More...

-

World Water Day celebrated at DPS MIHAN

DPS MIHAN observed World Water Day on March 22nd with a series of impactful activities aimed at raising awareness about the importance of water conservation... -

The Achievers PreSchool conducted a Sing along session for Play group & Nursery class.

The Achievers Pre-School recently orchestrated an enchanting event where young learners from Playgroup and Nursery classes came together with their parents and teachers for...