Nagpur News.

Wasankar Wealth Management which has hit the rough patch due to financial crunch is facing the heat of investors at its office. Everyday hordes of investors are dropping in at Wasankar’s office to get their money back after the word of it being operating in violation of norms spread across city and connecting areas. Wasankar has invited huge investment under promise of hefty returns only to back off from it later.

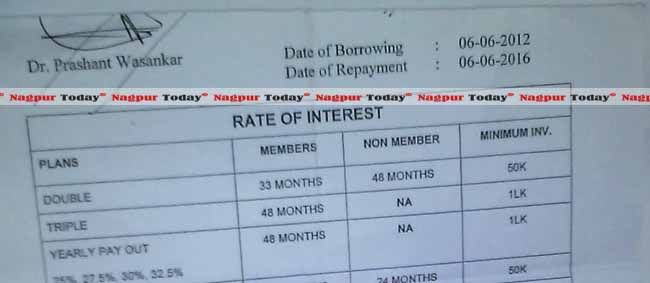

According to the norms, companies should not accept or renew deposits which are repayable after less than six months and more than 36 months. Also they cannot offer interest that is more than the approved rate, which may change from time to time (it is 12.5 per cent at present). But Wasankar has promised to almost double the deposits in short span of time.

Also the rules say that companies which have defaulted on payment of principal or interest in earlier schemes cannot accept/renew deposits. Going by the norms, now Wasankar should cease from operating any further as it has already defaulted on the payments starting from Rs 10 lakhs to a much as 1.75 crores.

Sources informed that a person who had invested Rs 3.5 crore in the luring proposition of Wasankar has almost lost all his money. Had he not alerted in the nick of time and applied pressure on Wasankar to return his money, he would have to part with the payment. Sources said that this person got the properties of Wasankar registered in his name, as Wasankar was reeling under acute financial crisis because of lacklustre delivery of market equities into which the company had parked investors’ money.

Another person who invested around 1.5cr with Wasankar is scheduled for maturity of his amount next month. It is learnt that Prashant Wasankar has offered only to pay 25% of the invested sum while the rest of the amount he has assured through post dated cheques.

Then there is age old man whose Rs 10 lakh is at stake in Wasankar. He was spotted in his office late nite on Monday,when asked about the chances of getting his money back he with tears is his eye’s informed that though Wasankar has promised to return but the conditions seem to be quite unfavorable.

Sources said despite seeing many such dubious schemes crashing in the past, the retail investors still invest in the such Ponzi schemes. The retail investors, scared of equity market volatility but not satisfied with returns from bank fixed deposits, mostly fell prey to dubious schemes that promise them the moon.

The greed to make ‘easy’ money is so intense it sometimes overpowers their financial wisdom. They get attracted to flashy schemes, promises of impossible returns and weird business models of little-known companies.

Norms for inviting deposits

According to the norms any company desirous of engaging in any business must register itself under the Companies Act, 1956. The Reserve Bank of India, or RBI, regulates non-banking finance companies, or NBFCs. These include loan companies, investment companies, asset finance companies and residuary non-banking companies. The Securities and Exchange Board of India, or Sebi, regulates listed companies, mutual funds and collective investment schemes (CIS). A CIS invests money pooled from investors in plantation and real estate ventures.

An NBFC must be registered with the RBI and have specific authorisation to accept deposits from the public. NBFCs which accept deposits should have at least an investment grade credit rating from an approved rating agency. NBFCs cannot offer an interest rate that is more than that approved by the RBI from time to time (which is 12 per cent at present). NBFCs cannot accept deposit for a period less than 12 months and more than 60 months.

What is a Ponzi Scheme?

It’s a scheme in which investors are paid from money collected from new investors instead of the scheme’s earnings. It works as long as new investors keep coming in.

Ponzi schemes are named after Charles Ponzi, an Italian who conned investors in the US and Canada. He promised clients a 50 per cent profit in 45 days by buying discounted postal reply coupons in other countries and redeeming them at face value in the US as a form of arbitrage.

Postal reply coupons were used by people in one country to send to a correspondent in another country, who could use them to pay for the postage for reply. These were priced at the cost of postage in the country of purchase but could be exchanged for stamps to cover the cost of postage in the country where redeemed; if these values were different, there was a profit to be made.

Ponzi claimed a net profit of 400 per cent could be made. In reality, however, the cost of transactions was higher than the profit to be made. Ponzi, though, continued to pay the promised returns to investors through money collected from new investors. His scheme caused investors a loss of $20 million in 1920.

– Rajeev Kushwaha ( rajeev.nagpurtoday@gmail.com )